21st April: MyGlamm, Mama Earth, Dream Sports, HealthifyMe & Mylo.

Most significant stories about the Indian startup & tech ecosystem in 120 seconds.

From The CapTable newsroom

Deals in Play: Venture-backed consumer brands brace for consolidation

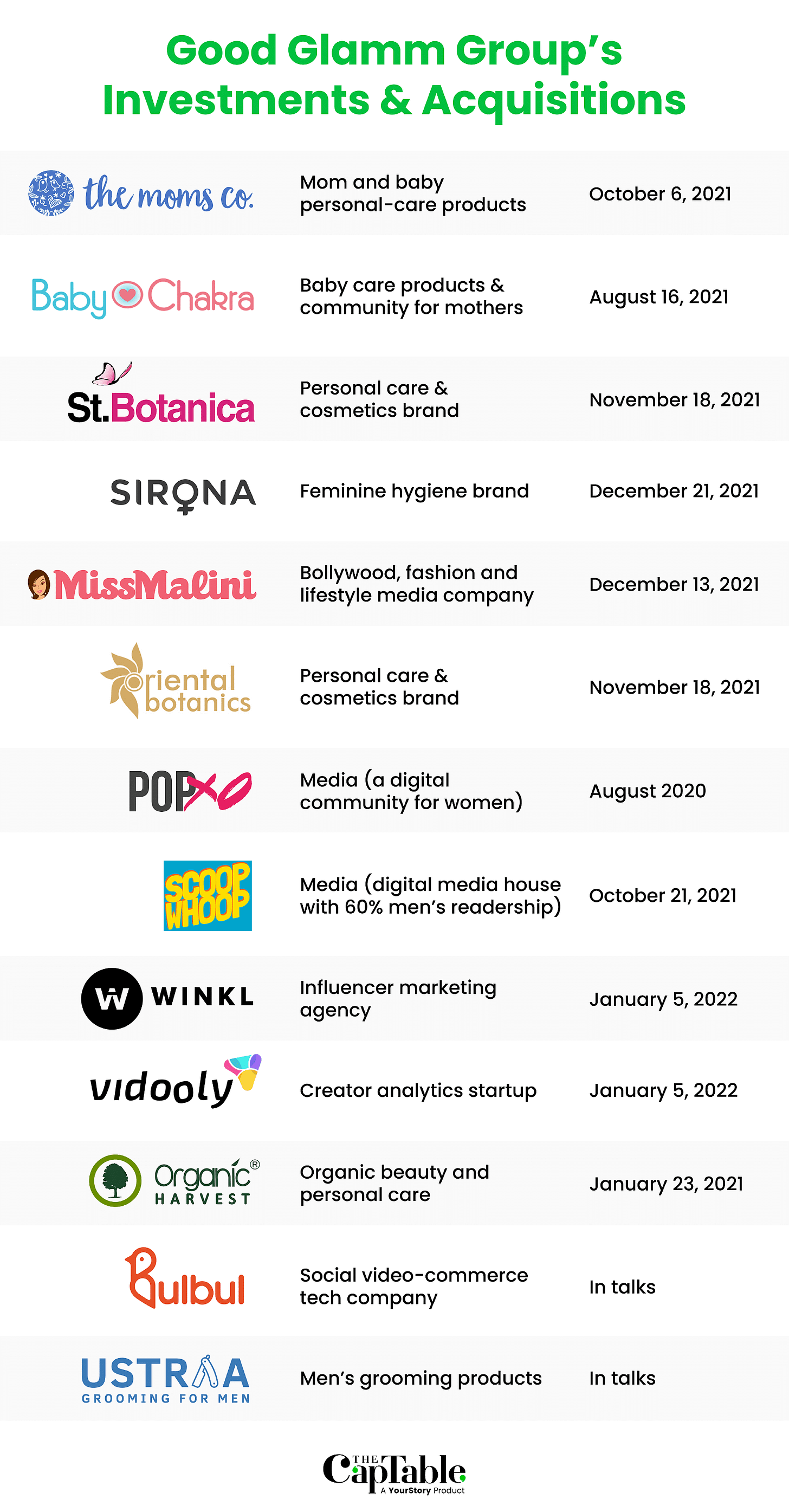

“If you cross Rs 150 crore in revenue and the growth is decent and burn not high, you can raise venture funding easily. If not, you need to start weighing options.” This statement by one of India’s top venture-capital managers captures a familiar reality of direct-to-consumer brands, which must shape up or ship out. Men’s grooming brand Beardo sold its business to FMCG major Marico when it had revenues of about Rs 60 crore. MyGlamm acquired The Moms Co for Rs 500 crore last year. Moms Co closed FY21 with a topline of Rs 48 crore. Haircare player BBlunt, which made Rs 50 crore in FY21, was bought by Mamaearth. It is getting even harder for D2C startups to raise capital because the market dynamics have made venture funds more discerning while backing players (read more).

Other significant stories about the ecosystem

Cricket non-fungible tokens (NFTs) platform Rario has raised $120 million, led by Dream Capital, the corporate venture capital and M&A arm of Dream Sports. Alpha Wave Global (previously Falcon Edge Capital) participated in the round, and now joins existing investors Animoca Brands, Presight Capital, and Kingsway Capital (read more).

Mumbai-based Inventys Research Company, a research-driven specialty chemical manufacturer focusing on custom synthesis and manufacturing (CSM) has raised Rs 225 crore through private placement from Plutus Wealth Management and Pantomath Capital Management (read more).

Nat Habit, a natural personal care direct-to-consumer (D2C) brand, has secured $4 million in a round led by early-stage venture fund Fireside Ventures, with existing investors participating (read more).

Singapore-based Believe Pte Ltd has raised $55 million in Series C funding from investors led by Venturi Partners and IIFL AMC. Existing investors Jungle Ventures, Accel, Alteria Capital and Genesis Alternative Ventures also participated in the round. The company has raised over $80 million across three funding rounds (read more).

Health and wellness platform HealthifyMe is mulling an initial public offering (IPO) in the next 24 months even as it plans to clock an annualised revenue run rate (ARR) of $200 million around the same time (read more).

Mylo, a platform for expecting and new mothers, has announced a funding round of $17 million led by W Health Ventures, a US-based digital health investor, ITC and Endiya Partners. Other investors that participated in the round include Riverwalk Holdings, Alteria Capital and Innoven Capital. With this, Mylo has raises $24 million to date (read more).